Chinese server-maker and contract manufacturer Inspur has detailed a memory cooling tech it claims doubles the heat dissipation efficiency of traditional air cooling without complicating system maintenance.

Unsurprisingly, Inspur cited AI as the reason its tech is needed – because the workload creates demand for servers packed with memory. All that DRAM, and AI servers’ need for other parts, means motherboard space is at a premium.

Inspur cited designs based on Intel’s fifth generation Xeon Scalable processors as a prime example of this conundrum. Apparently the narrowest memory spacing supported is as a mere 7.5mm – 30 percent smaller than the 10.7mm allotted during the 2007 to 2015 era of DDR3 RAM.

In those tiny spaces, Inspur asserts, air cooling is not viable.

A “sandwich” structure that sees liquid-cooled cold plates acting as conductive thermal dissipators fitted between memory modules is doable, but tough to implement in the space available. Inspur worries it requires thinner cold plates, which can complicate manufacturing and reduce structural integrity leading to breakage.

Inspur also worries the sandwich structure is more difficult to install and maintain, increasing the risk of damage.

The biz reckons it’s found a fix with a “sleeper architecture.”

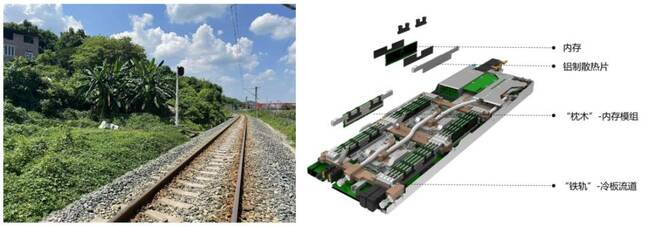

“The solution draws inspiration from the design of railway sleepers. A memory module is composed of aluminum heat sinks, heat pipes, clips and memory, which is similar to sleepers and laid on tracks composed of cold plate channels at both ends,” explained the Chinese server-maker.

The heat pipes and aluminum heat sinks transfer heat from the memory to cold plates, bypassing the need for the “sandwich” structure.

Each memory module has its own separate heat dissipation aluminum sheet, which can be removed together as a unit.

“The decoupling design of the memory module greatly improves the convenience of hot-swapping a single memory,” claimed Inspur. “When the memory is damaged, you only need to remove the memory module for maintenance without disassembling the memory module as a whole.”

Inspur reckons this railway design has some extra benefits in the form of fewer welded points, which reduces the risk of leakage, and the ability to adapt to different slot spacing – providing the design with the potential to act as a standard.

Inspur is a key contributor to the Open Compute Project (OCP), which facilitates the sharing of datacenter product designs and plays a role in standard setting.

While specifications developed under the OCP are typically royalty-free, Inspur did not say if the specifics of its “sleeper” design would be shared in the same way.

The OCP, along with Meta, is largely driving many of the memory-centric liquid cooling efforts.

Other explorations of new liquid cooling techniques focus on CPUs and GPUs – as is the case with Nvidia, and Hewlett Packard Enterprise (HPE) through its acquisition of Cray. Supermicro uses similar cooling plates in liquid cooling to handle increased heat from high-density set-ups, as does Lenovo’s Neptune system.

Chinese state-sponsored media suggested the updated design is paying off for Inspur, in a surge in liquid-cooled server sales.

State media also attributed the sales spike and development of the sleeper system to a national government mandate.

In early 2023, Beijing introduced the “Action Plan to Promote Large-Scale Equipment Updates and Trade-in of Old Consumer Goods,” which aims to encourage the modernization and replacement of outdated equipment – particularly in industries with high energy consumption, such as datacenters.

Inspur has reportedly upgraded its production lines for testing and assembly of liquid-cooled servers. China’s predominant state television broadcaster CCTV stated that with these manufacturing updates, Inspur’s factory can produce more than 300,000 liquid-cooled servers annually.

US server-maker Supermicro, which has also increased capacity of kit to manufacture liquid-cooled servers, has said it will soon be able to build 3,000 racks full of such kit each month. Assuming servers in those racks are 2U, and each rack needs a 2U top-of-rack switch, Supermicro is therefore filing each rack with 20 servers. Three thousand racks a month at that rate would mean 60,000 servers a month, or 720,000 servers a year for liquid-cooled rackscale systems alone.

At 300,000 liquid cooled servers a year, Inspur is well behind Supermicro, if our back-of-the-envelop numbers are right.

But while Supermicro sells to the world, Inspur has fewer potential customers. In 2023 the Chinese datacenter player was added to the US Department of Commerce’s Entity List, meaning US customers need a special license to buy its kit. ®

Bisnis Jatim Tajam, Lugas dan Faktual

Bisnis Jatim Tajam, Lugas dan Faktual